Sourcing liquidity for tokenized assets

How do we source liquidity staked on Defi for tokenized traditional finance ?

Tokenizing various assets like shares, loans, funds, asset-backed securities, and structured products can be pursued with different objectives. However, the primary measure of success for such endeavors is often the amount of capital raised for tokenized products and the expansion of the investor base for the issuing entity.

As the novelty of tokenization technology using blockchains wanes and fintechs funded by venture capital, along with corporate innovation departments, become more accustomed to creating tokenized assets or digital securities, the focus will shift to tokenization's impact on businesses.

Our main focus at the Verified Network has been the distribution of tokenized assets and the sourcing of capital and liquidity. The Verified Network is decentralized blockchain powered financial infrastructure that enables issuing of security tokens by regulation compliant issuers. Security tokens issued on the Verified Network or by third party tokenization engines are paired with cash tokens to create liquidity pools. Cash tokens typically comprise stablecoins like USDC or fiat-backed tokens such as EURe issued by licensed electronic money issuers. Capital is sourced for liquidity pools through integrations of the Verified Network with on-chain DeFi platforms and licensed off-chain brokerages.

At this point, it is important to ask what is in it for investors when it comes to investing in tokenized assets ? While issuers of tokenized assets seek out institutional investors, the business case for this investor class is yet not established. Tokenizing private assets does offer benefits of secondary liquidity and make them accessible with smaller ticket sizes, but institutional investors are more likely to hold investments long term and do not benefit from smaller subscription tickets. This is why we see that even as more and more institutions talk about and experiment with issuing tokenized securities, liquidity and capital is still a big challenge even for licensed trading venues targeting qualified investors. Investors on Defi platforms, on the other hand, have digital assets staked on them and seek out stable and additional returns from them.

Here are examples of Defi yields and digital assets staked in some crypto asset pools. TVL or Total Value Locked is the measure of liquidity in each pool, and the selection below has pools with more than $100 million each. TVL for all of Defi is in the tens of billions of dollars.

However, sourcing Defi liquidity presents a significant challenge due to its fragmented nature, spread across numerous crypto assets and various blockchains like Polygon, Avalanche, Gnosis, and the Ethereum mainnet. The complexity arises from liquidity pools for tokenized assets, which involve pairing a security token with a cash token like USDC. Managing multiple liquidity pools for a single security token can be daunting for issuers. Pairing security tokens with volatile crypto assets is also a risk management challenge for issuers. For investors, swapping digital assets to procure cash tokens required to invest in security tokens could be complex and inefficient, and each swap can consume a fair amount of fees (gas costs).

That is why we have implemented liquidity pools for tokenized assets on the Verified Network in a way that they can aggregate liquidity from multiple Defi platforms and enable one-click, seamless and gas efficient swaps for investments in security tokens. We initiated collaboration with the Balancer protocol in 2021 to enable creation of custom, regulation-compliant liquidity pools for tokenized assets. Balancer, a popular decentralized exchange for cryptocurrencies, also powers liquidity pools on various other DeFi platforms, consolidating asset balances of investors in a single smart contract called the Balancer Vault. By leveraging the Balancer protocol, liquidity pools for new issuances and secondary offerings of tokenized assets on the Verified Network enable investors and liquidity providers utilize their existing crypto asset balances in the Balancer vault to invest in tokenized assets. Liquidity (TVL) on Balancer has reached up to $2 billion, and swaps between liquidity pools in the Vault are highly cost-efficient in terms of gas fees.

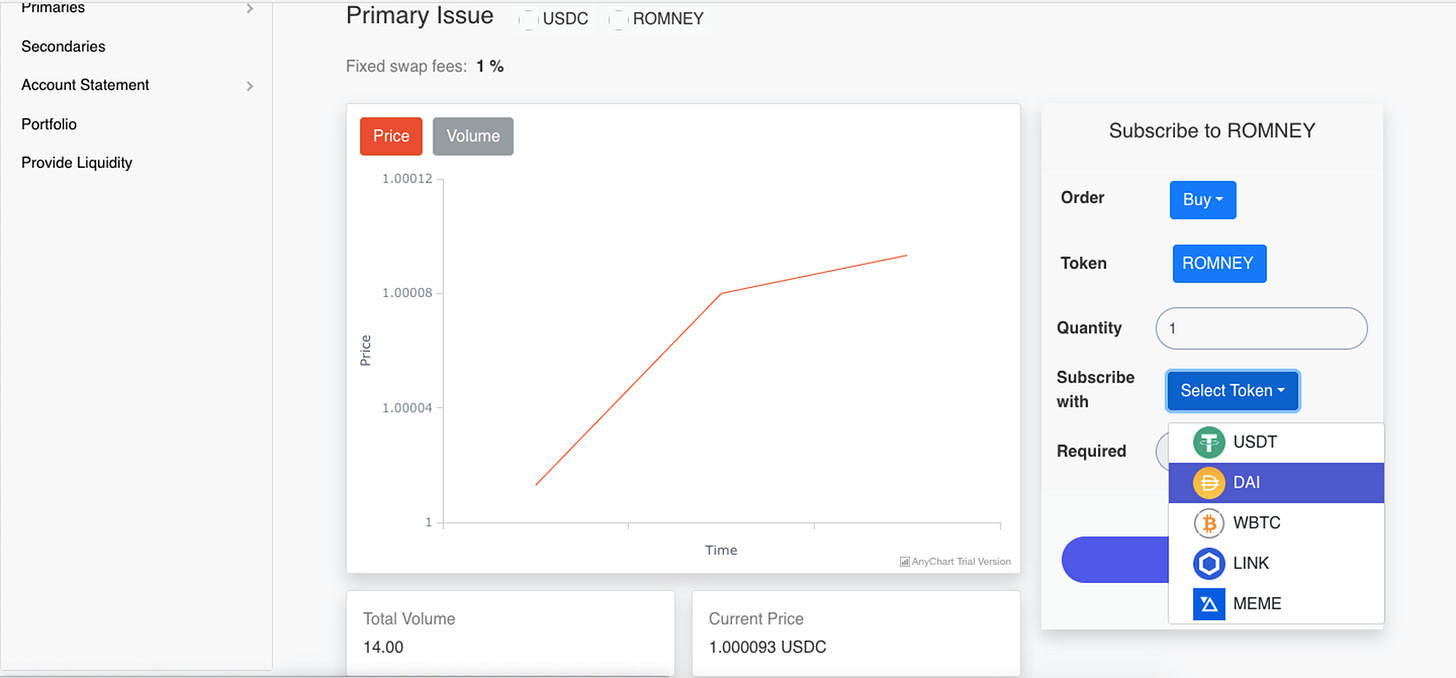

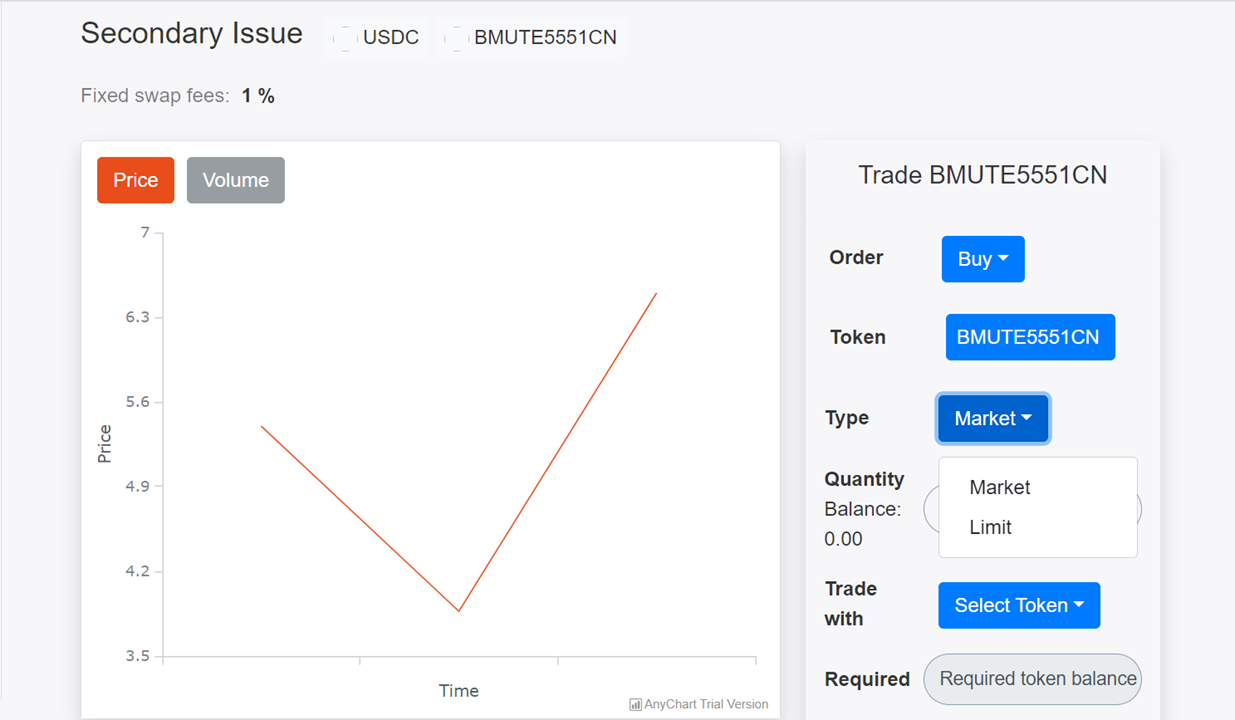

Liquidity pools for new issues on the Verified Network are integrated to workflows for KYC/AMLA checks on investors, managing allotments and refunds of subscription capital, corporate actions including distribution of interest and dividends, and custody of assets for issuer organizations. Liquidity pools for secondaries on the Verified Network feature a fully onchain limit order book and integrates with workflows for trade settlement, portfolio management and KYC/AMLA checks on investors. Liquidity pools on the Verified Network can also be created for tokens issued using third party tokenization engines. The system supports native security tokens that are registered with blockchain resident depositaries managed by licensed registrars as well as security tokens that represent underlying securities registered with centralized securities depositaries.

(Above) Liquidity pool for new issue with USDC as cash token but supporting subscriptions using many other crypto assets that uses the Verified Network’s smart router to instantly exchange into USDC (Below) Secondary trading pool featuring a fully on chain limit order book

To aggregate liquidity from other Defi platforms, liquidity pools on the Verified Network use a smart order router. This allows investors to exchange any crypto asset they hold in their wallets instantly into the cash token paired with the desired security token. The smart order router utilizes best execution algorithms, enabling the execution of single or multiple swaps to obtain the most favorable price and minimize slippage. The order router aggregates liquidity from more than ten decentralized exchanges, including Uniswap V2 and V3, Curve, Kyber, and others. This integration means that liquidity staked on these Defi platforms can be utilized by investors to invest in tokenized assets seamlessly.

(Above) Total Value Locked (TVL) of Defi protocols supported by the Verified order router

In addition to over $10 billion in liquidity aggregated on connected decentralized exchanges, we have begun work on supporting tokenized asset markets on the Compound protocol. This will enable tokenized debt issuers to borrow base assets such as USDC in exchange of collateral which is supplied by guarantors on the protocol. We will cover this work in a separate post.

The effectiveness of Defi platforms as liquidity sources for tokenized real-world assets is already evident. The Maker protocol, for instance, has seen a deposit of $680 million in tokenized assets into its vaults since mid-2020, when it approved the inclusion of real-world assets.

The Verified Network is free to use - there are no onboarding costs, subscription charges, software licensing costs - and contracts are deployed on public EVM compatible blockchains, and all you need to do to get started is do your KYC. Feel free to provide your feedback to us and reply back to this post if you want access to the infrastructure, and share it with people you think may benefit or be interested.